Product providers

Digital administration solution for your corporate customers

When it comes to company pension schemes, today’s employers expect digital processes and online services that are fast, and intuitive. Do you want to position yourself as a professional provider in the digital era?

Digital platform for insurers, mutual funds, and social partners

The P·LIVE digital platform administers pension plan products for insurers, mutual funds and social partners simply, digitally, and efficiently. P·LIVE records all contracts and customer data in a centralized database. The administration processes and the entire customer journey is fully digitized and highly automated via application programming interfaces (APIs) linking all involved parties (employer, employee, product provider, security trust, financial investment management company, depository bank, supervision, bookkeeping, etc.).

Central data management

The process participants are centrally coordinated via an administration system, receive fully automated reminders, and are integrated into a comprehensive communication workflow. Changes to contracts and data as well as new assignments are carried out online by each user individually via portals, directly validated, and stored in the cloud. Status reports, statistics and ongoing reporting are available at a high quality with a single click. All investment processes are automated.

Employee portal

The creation of staff portals allows employees to access and alter their contracts, approvals, and documents or conclude new contracts. Contract conclusions or changes can be conveniently carried out online.

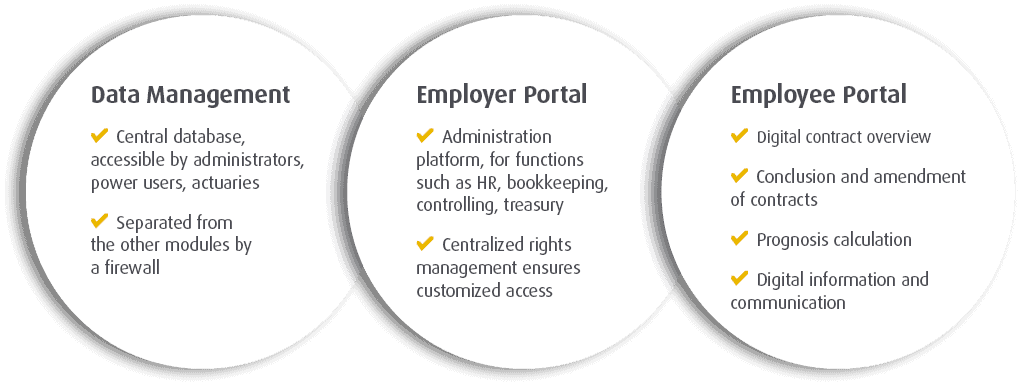

P·LIVE consists of three modules, each aimed at a different user group:

The data management module serves central data storage. It is separated from the other two modules by a firewall. This way, P·LIVE fulfills all data safety requirements.

RANGE OF OFFERS FOR COMPANY PENSION SCHEME, TIME-VALUE ACCOUNT, AND PARTIAL RETIREMENT SYSTEMS

The employer portal offers:

- Error-free performance appraisals, calculations, simulations at all times

- Constant availability of all current data

- Documentation of all processes and process steps in the workflows

- Data transfer via interface to all participants

- Virtual individual account management for all pension schemes

- Automated pension payments, incl. adjustments

- Automated investment processes

- Automated account and depot control

- Automated pension rights adjustment

- ewiges, revisionssicheres Prozessarchiv

- Permanent, auditing-acceptable process archives

- Preparation and system-based mailing of employee letters

- Adjustable standard reports

- Data security through central data storage and central competence management

- Digital self-determination guaranteed by German law

The employee portal offers:

- A customer-specific Internet address and individual design

- Responsive design

- m-Tan method for order authorization, eg. within the EU

- The entire pension plan in a single portal

- Visual presentation of the pension account

- Conclusion or change of contracts on a self-service basis

- Paperless deferred compensation via e-voting

- Error-free performance appraisal, calculation, simulation

- Tax calculations for net salary waivers

- Download of annual account information

- Availability of documents such as company agreements, capital investment information, etc.

- Data updates by the employee

- Arrangement of consulting meetings, information requests

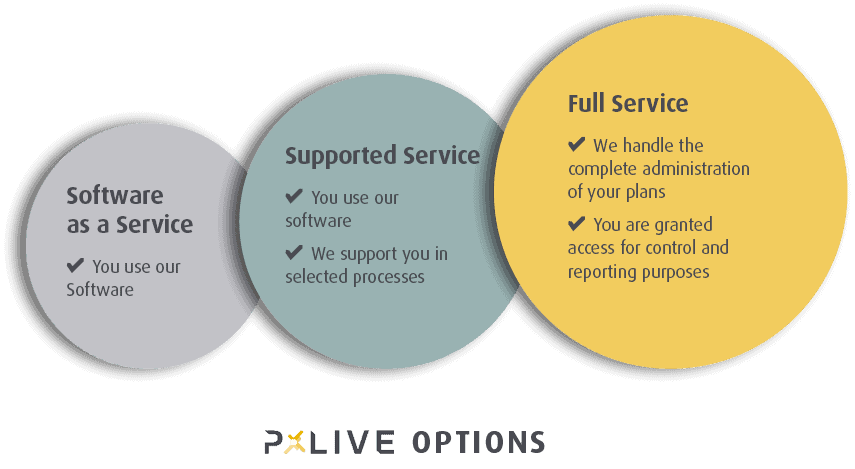

Models

Models

P·LIVE offers flexible models. You can choose among our full service, supported service, or software-as-a-service options. Even purely API use is readily available.